mobile al sales tax rate 2019

The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma. Begränsade öppettider under sommaren samt julhelger.

Locations Mobile County Revenue Commission

Enero 19 2021 en Uncategorized por.

. A county-wide sales tax rate of 15 is applicable to localities in Mobile County in addition to the 4 Alabama sales tax. The minimum combined 2022 sales tax rate for Mobile Alabama is. What is the sales tax rate in Mobile County.

Mobile Sales Tax Rates for 2022. This rate includes any state county city and local sales taxes. Information Motor Vehicle Business License Sales Tax Online Filing Using ONE SPOT-MAT.

Impingement inklämd sena. Section 34-22 Provisions of state sales tax statutes applicable to article states The taxes levied by this article shall be subject to all definitions. The Mobile Alabama sales tax is 1000 consisting of 400 Alabama state sales tax and 600 Mobile local sales taxesThe local sales tax consists of a 150 county sales tax and a 500.

The Alabama sales tax rate is currently. City Ordinance 34-033 passed by the City Council on June 24 2003 went into effect October 1 2003. The Mobile County Alabama sales tax is 550 consisting of 400 Alabama state sales tax and 150 Mobile County local sales taxesThe local sales tax consists of a 150 county sales.

This is the total of state county and city sales tax rates. Mobile County Tax Rates. Among major cities Chicago Illinois and Long Beach and Glendale California impose the highest combined state and local sales tax rates at 1025 percent.

Mobile al sales tax rate 2019. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and. Per 40-2A-15 h taxpayers with complaints.

24 rows SELLERS USE. This is the total of state and county sales tax rates. There is no applicable.

The 10 sales tax rate in Mobile consists of 4 Alabama state sales tax 1 Mobile County sales tax and 5 Mobile tax. 2020 rates included for use while preparing your income tax. Mobile in Alabama has a tax rate of 10 for 2022 this includes the Alabama Sales Tax Rate of 4 and Local Sales Tax Rates in Mobile totaling 6.

The County sales tax. Online Filing Using ONE SPOT-MAT. Sales and Use taxes have replaced the decades old Gross Receipts tax.

Sales and Use Tax. 1 lower than the maximum sales tax in AL. Mobile Al Sales Tax Rate 2019.

The latest sales tax rate for Mobile County AL. The latest sales tax rate for Mobile AL. Restaurants In Matthews Nc That Deliver.

The minimum combined 2022 sales tax rate for Mobile County Alabama is 10. Some cities and local. 2020 rates included for use while preparing your income tax deduction.

This rate includes any state county city and local sales taxes. The Mobile County Sales Tax is 15. Opry Mills Breakfast Restaurants.

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Alabama Sales Use Tax Guide Avalara

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Sales Tax On Grocery Items Taxjar

States With Highest And Lowest Sales Tax Rates

Mobile Alabama Al Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sales And Use Tax Rates Houston Org

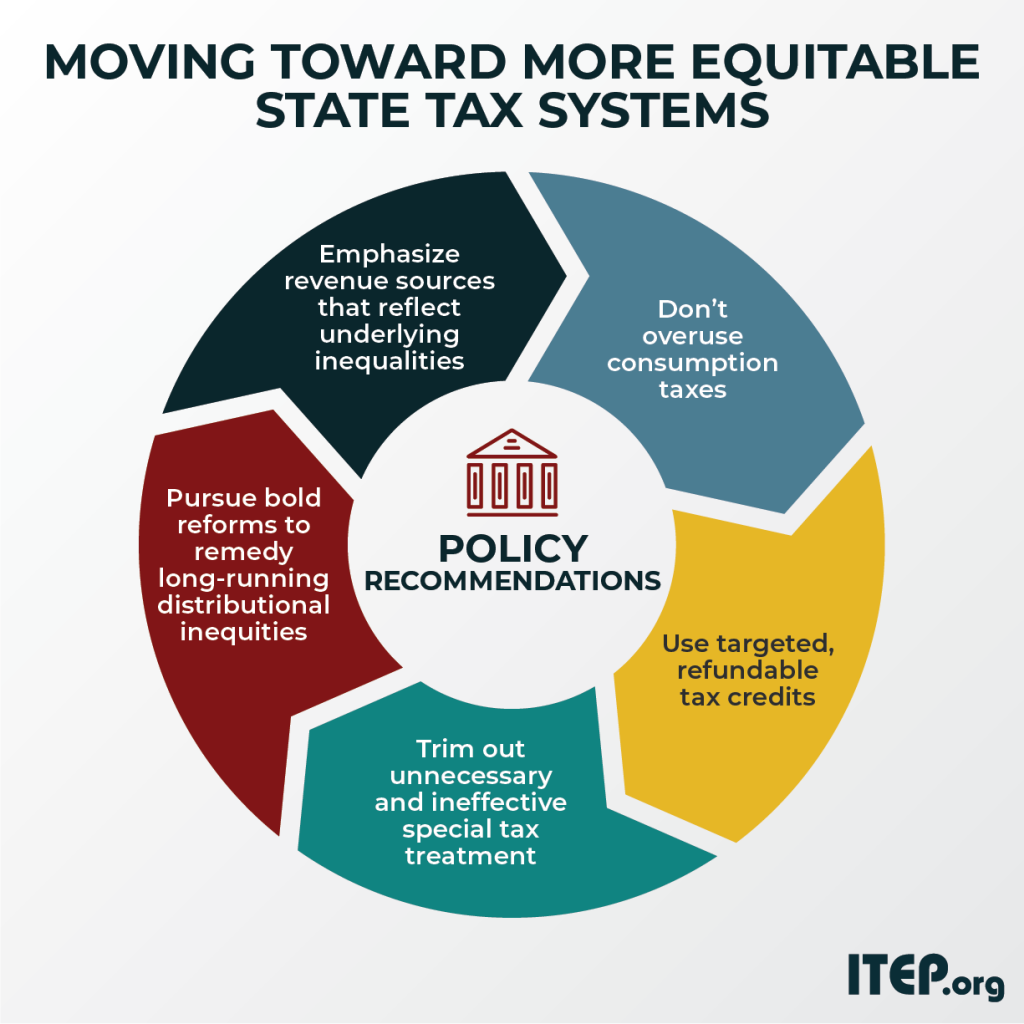

Moving Toward More Equitable State Tax Systems Itep

Alabama Sales Tax Rates By City County 2022

How Do State And Local Sales Taxes Work Tax Policy Center

World Cellular Cellphone Equipment Market Business Evaluation And Forecast 2019 2026 Global Mobile Mobile Phone Accessories Phone Accessories

North Carolina Sales Tax Small Business Guide Truic